|

|

|

|

|

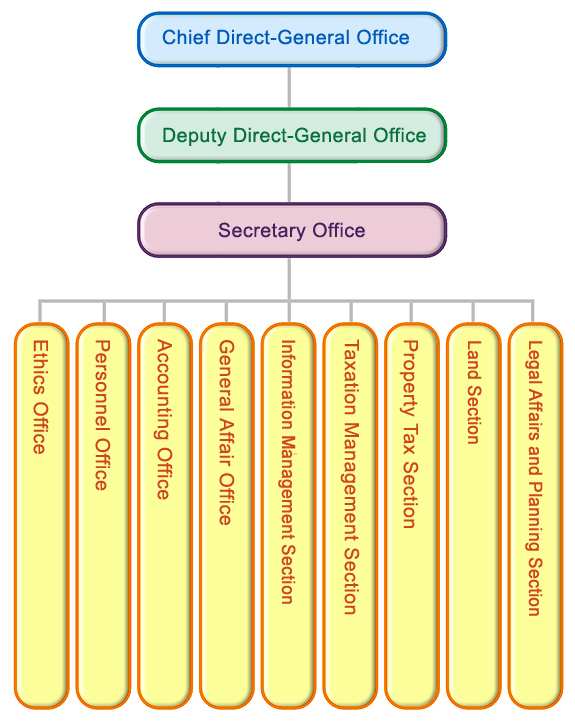

General

Affair Office |

| |

File processing and task

administration, treasury, file

management

|

|

Legal

Affairs and Planning Section |

| |

Tax service, regulations and law education

Administrative remedy, fine,

management of Cases of Tax Evasion

Against Law

|

|

Property

Tax Section |

| |

Vehicle

License Tax Subsection:

Collection of vehicle license tax

House Tax

Subsection:

Collection of house tax and deed tax

|

|

Land

Tax Section |

| |

Land Value Tax

Subsection:

Collection of farm tax and land

value tax

Land Value

Increment Tax Subsection:

Collection of land value increment

tax

|

|

Taxation

Management Section |

| |

Internal

inspection

Tax Overdue

Subsection:

Execution of tax overdue

Amusement and

Stamp Tax Subsection:

Collection of amusement tax

and Stamp tax ,tax evasion

investigation

transfer and release of tax payment,

management of receipts and licenses,

tax refund management and research,

evaluation, audit, and verification.

|

|

Information

Management Section |

| |

Development, lectures and training,

and guidance of application system,

execution of system, file

management, electronic filing and

submission of electronic files

M Sever operation, control of

information operation

|

|

Accounting

Office |

| |

A/P, A/R, and tax statistics

|

|

Personnel

Office |

| |

Organizational structure, job

categorization, appointment and

dismissal, civil service,

simplifying job responsibilities,

supervising temporary workers,

reward, punishment, performance

review, retirement, training,

insurance, welfare, vacation

arrangement

|

|

Ethics

Office |

| |

Public affairs confidentiality,

security maintenance, investigation

of civil service ethics, property

filing of public servants

|